Health care industry observers frequently ask “is value-based-care finally gaining traction in the industry?” and skeptics will follow with “is value-based care even the right care model to achieve utilization saving goals for a population?” The answer to the first question is undoubtedly, yes. The answer to the second question has been less clear, until now. A new study from the Journal of the American Medical Association (JAMA) is shedding light on the impact that dual-sided risk models (arrangements with both up-side and down-side financial outcomes for providers) can have at achieving the goals of value-based care.

One indicator of the broader acceptance of value-based care is the amount of funding flowing into innovative digital health and value-based care organizations by investors. For example, a Deloitte study of Rock Health’s database revealed that the amount of funding for healthcare technology companies increased from $7 billion in 2019 to $14 billion in 2020. Another is the ever-growing enrollment of members in value-based care programs nationally, understanding that payers and employers are placing greater reliance on this approach.

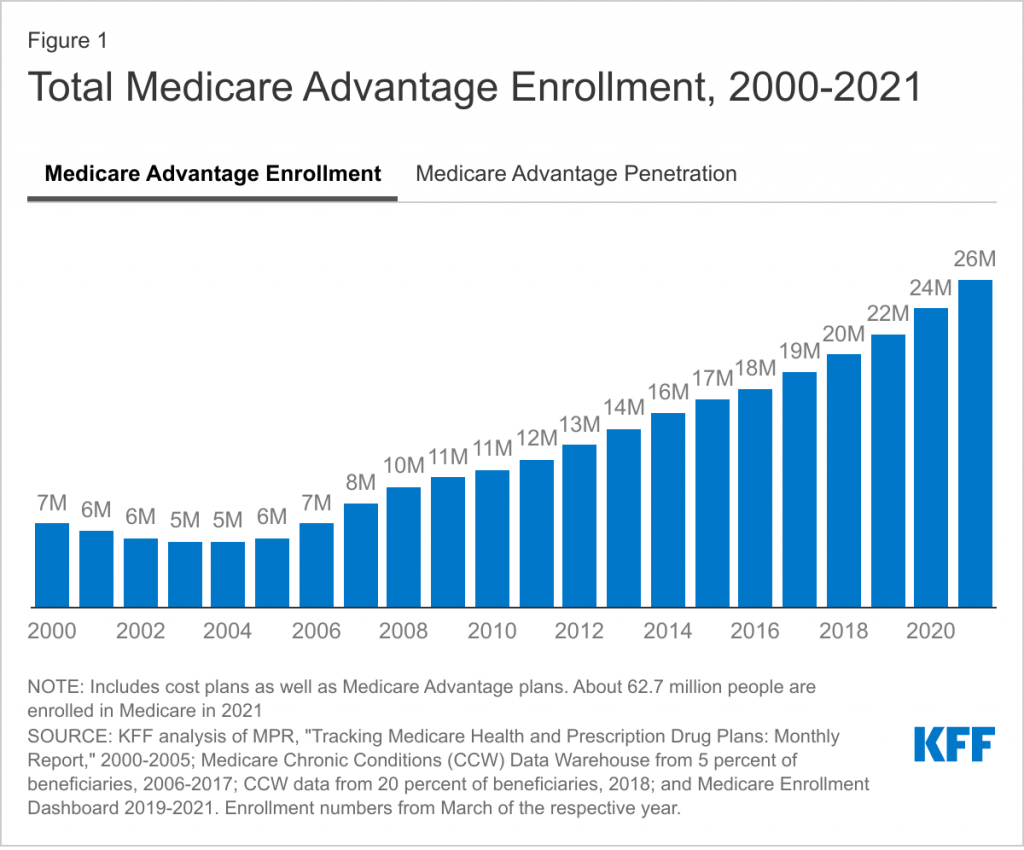

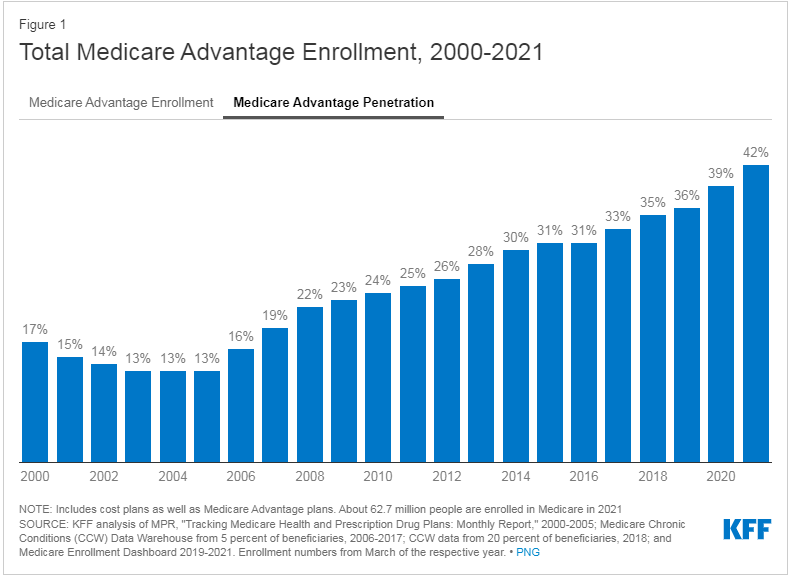

Just examining the enrollment and penetration of Medicare Advantage (MA), the most well-known and deeply studied version of value-based care models, indicates a terrific level of adoption nationally. A recent report from the Kaiser Family Foundation shows that enrollment of MA continues to grow, not just with government program recipients but also including those enrolled in employer sponsored plans.

- In 2021, there were 26 million MA enrollees, up from only 12 million in 2011

- Nationally, the level of penetration has risen from only 25% in 2011 to 42% of all Medicare beneficiaries in 2021

The second question of value-based care’s fit is constantly under evaluation, but with more data we have a better understanding of how effective these programs can be. One JAMA study provides evidence that value-based models are achieving the desired utilization savings compared to a standard fee-for-service (FFS) model. However, there is an important distinction between the model construction and effectiveness.

The study, which examined pre-COVID data from 2017 to 2019, found that the outcomes and utilization savings for these beneficiaries are only improved when they are enrolled in dual-sided models. The results indicated lower ED use, fewer hospitalizations, and fewer observation days when members were cared for by providers in a dual-sided risk model. For example:

- ED visits reduced by 13.4% from 434 to 375 per 1,000 beneficiaries

- All cause hospitalizations were reduced by 4.2%

These are all outcomes that result in improved wellness and lower medical costs for populations everywhere. The study did not find comparable reductions in utilization when comparing up-side only models to standard FFS.

This means we cannot simply expand programs like MA to achieve the desired wellness improvements without careful design that emphasizes a full risk profile for the providers. The researchers do acknowledge that there may be some selection bias: organizations accepting dual-sided risk are likely to be those with investments in tools and infrastructure to manage chronic disease and population health.

This study suggests that the best way to optimize performance under value-based care is to design dual-sided models and support those care teams with a technology and service platform that brings providers information to make the right decisions at the point of care. Examples of these tools discussed in the article include screening and testing reminders, accurate illness burden capture, and other wellness enhancing actions. These are all actions and decisions supported and improved by the behavioral economic model on the Stellar platform.

Achieving a broader adoption of dual-sided models will require practices, both large and small, understanding that they have the information available and motivation to be financially successful in a value-based model. Getting to the next level of value-based care success requires solving the incentive divide that exists between the risk model and the day-to-day economic reward of delivering per unit care. To transform the industry from a FFS workforce into a Fee-For-Value, we must find ways to support provider financial sustainability under these dual sided models and make it easier to adopt this approach, or we’ll continue to ride the utilization ramp upward the same as we do under an FFS model.

How can we help you?

- View a product demo

- Schedule a meeting

- Partner with us